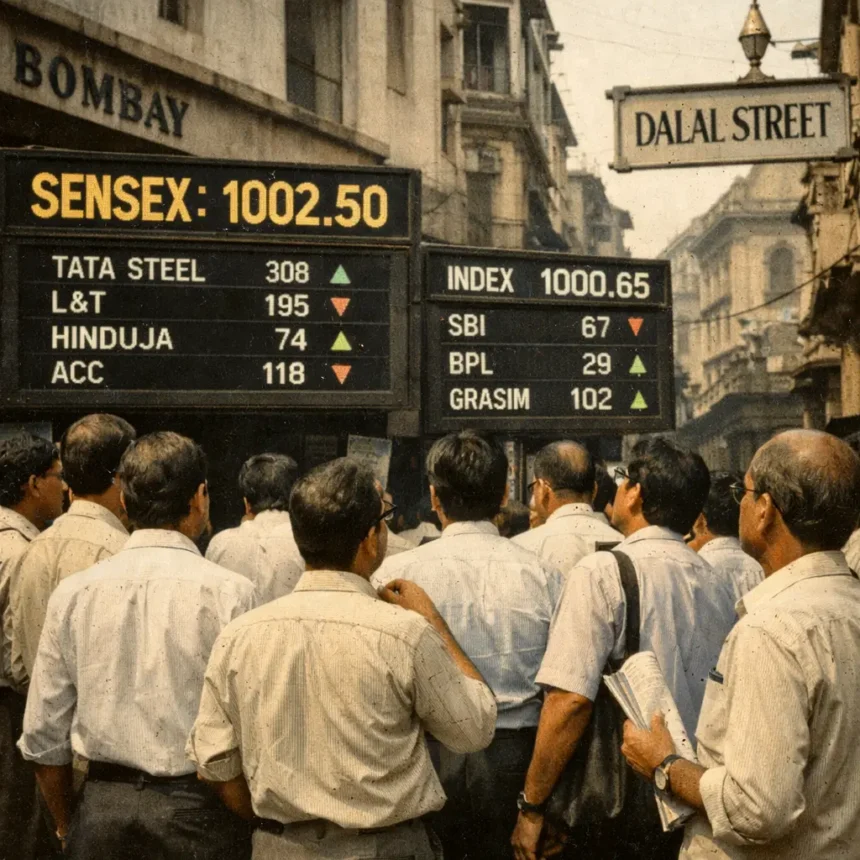

Sensex in 1990: When Dalal Street Saw Wild Swings

In today’s world of 70,000-plus levels, it’s hard to imagine a time when the Sensex was moving around just 1,000 points. But that’s exactly where India’s stock market stood in 1990 – a year remembered for sharp ups and downs, political chaos, and the early signs of big changes in the economy.

For many investors, 1990 was the first real taste of how unpredictable the stock market could be.

Where the Sensex Stood in 1990

At the start of 1990, the Sensex was hovering close to the 1,000 mark. Back then, this itself was seen as a big achievement for the Indian market.

In the next few months, things moved fast. By around March 1990, the index climbed to nearly 1,300 points. There was excitement on Dalal Street. Stocks were rising, trading volumes were picking up, and many new investors were jumping in, hoping to make quick gains.

But the rally didn’t last.

As the year went on, the mood changed. By the end of 1990, the Sensex had slipped back to roughly 1,000-1,050, giving up most of what it had gained earlier.

In simple terms, 1990 ended almost where it began – but not before taking investors on a roller-coaster ride.

Why the Market Shot Up Early in the Year

The early rally in 1990 came from a mix of optimism and easy money in the system.

Banks were lending freely, and there was growing interest in equities among ordinary people. Some stocks were seeing heavy buying, pushing prices higher day after day. For many, it looked like the market had entered a new, exciting phase.

At the time, few questioned whether these sharp moves were sustainable.

Political Storms Add to the Uncertainty

1990 was not a calm year for Indian politics. Governments were unstable, leadership changed, and there was uncertainty about the direction the country was headed.

Markets don’t like uncertainty.

As political noise grew louder, investors became cautious. Big players started cutting back on their positions. That nervousness slowly showed up on the Sensex, which began to lose steam after its March peak.

The Fall: When Reality Hit Dalal Street

After touching around 1,300, the Sensex started sliding. The selling gathered pace as worries mounted about:

- Tight liquidity in the system

- Rising inflation

- A slowing economy

- And global tensions, including the Gulf War

By the later part of the year, prices had dropped sharply. For many first-time investors who had entered near the top, it was a rude shock.

By December 1990, the Sensex was back near 1,000, reminding everyone that markets can fall just as quickly as they rise.

The Shadow of Harshad Mehta

When people talk about the early 1990s, the name Harshad Mehta often comes up. Though the famous securities scam exploded in 1992, the unusual activity in certain stocks had already begun earlier.

In 1990, some shares were being pushed up aggressively, creating a sense that the market was stronger than it really was. At the time, most investors had no idea what was going on behind the scenes.

Only later did it become clear that the seeds of the big bubble were being sown around this period.

India’s Weak Economy in 1990

The stock market’s struggles were closely linked to the country’s economic condition.

By 1990, India was facing serious problems:

- Foreign exchange reserves were dangerously low

- The fiscal deficit was rising

- Inflation was high

- Growth was slowing

These pressures were building up towards what would become the balance of payments crisis in 1991. The Sensex, as always, reflected these worries even before the crisis fully unfolded.

How Investors Lived Through 1990

For investors, 1990 was an emotional year.

Some who had made quick gains in the early rally tried to book profits. Others held on, hoping the market would bounce back. Many new investors, seeing their savings shrink, exited in panic.

There were no fancy apps or real-time data back then. People depended on newspapers, brokers, and word of mouth. Every big move on the Sensex became a talking point.

The year taught a hard lesson: the stock market is not a one-way street.

Then vs Now: A Different World

Looking at today’s Sensex levels above 70,000, the numbers from 1990 seem tiny. But they tell the story of how far India’s markets have come.

Back then:

- The market was smaller

- Participation was limited

- Information was harder to access

- Regulation was still evolving

Today, millions invest through apps, mutual funds, and SIPs. Foreign investors track India closely. The journey from around 1,000 to today’s heights reflects the transformation of the Indian economy.

What 1990 Taught Indian Investors

The events of 1990 left behind lessons that still matter:

- Don’t get carried away by sudden rallies

- Understand what you’re investing in

- Be prepared for volatility

- Think long term, not just short-term profits

- And remember that markets reflect the bigger economy

Many who stayed invested through the ups and downs eventually benefited in later years.

Setting the Stage for 1991 Reforms

The stress seen in 1990 didn’t go away. In fact, it worsened in 1991, when India faced a full-blown economic crisis.

That crisis forced the government to introduce major reforms – opening up the economy, welcoming foreign investment, and modernising financial markets.

Those reforms became the foundation for the long bull run that followed in the decades ahead. In a way, the struggles of 1990 were the beginning of a new chapter.

Why Sensex in 1990 Still Matters Today

So why look back more than three decades?

Because 1990 shows:

- How fragile markets can be

- How closely stocks follow economic health

- And why strong systems and regulation are so important

Every big market today carries lessons from its past. For India, 1990 is one of those key years.

Final Word

The answer to “what was the Sensex in 1990?” is simple in numbers – it moved from around 1,000 to nearly 1,300, and then back to around 1,000 by year-end.

But in spirit, 1990 was much more than just numbers. It was a year of hope, fear, mistakes, and learning for Dalal Street.

It reminded investors that markets test patience, reward discipline, and always move in cycles – lessons that are just as true today as they were back then.

Reviewed for accuracy and last updated on December 24, 2025.