Nifty Commodities Index: A Guide to India’s Commodity Stocks

The nifty commodities index has become an important benchmark for investors who want exposure to India’s commodity-driven companies. From metals and mining to cement and oil & gas, this index tracks businesses that form the backbone of the country’s industrial and infrastructure growth.

In this article, we explain what the nifty commodities index is, how it works, which stocks it includes, its performance, risks, and how investors can use it as part of a diversified portfolio.

What Is the Nifty Commodities Index?

The nifty commodities index is a sectoral index maintained by NSE Indices. It tracks the performance of companies listed on the National Stock Exchange (NSE) that are primarily engaged in commodity-related businesses.

These include firms involved in:

- Metals and mining

- Oil & gas exploration and refining

- Cement and building materials

- Power and energy

- Chemicals and fertilisers

In simple words, the nifty commodities index reflects how India’s core commodity producers are performing in the stock market.

Why the Commodities Sector Matters

Commodities are the building blocks of any economy. Steel builds bridges, cement builds cities, oil powers transport, and power fuels industries.

In India, commodity companies play a vital role because:

- Infrastructure growth depends on them

- Manufacturing relies heavily on raw materials

- Energy demand is rising with development

- Global prices directly impact earnings

That’s why the nifty commodities index is often seen as a mirror of India’s industrial health.

How Is the Nifty Commodities Index Constructed?

The index is formed from eligible NSE-listed stocks based on:

- Belonging to commodity-related sectors

- Free-float market capitalisation

- Liquidity and trading volumes

- Compliance with NSE rules

Like most NSE indices, it follows the free-float market cap method, meaning only shares available for public trading are counted.

Bigger companies have more weight, so their price movements affect the nifty commodities index more.

What Kind of Companies Are in the Index?

The stocks in the nifty commodities index usually include leaders from:

- 🛢️ Oil & gas (exploration, refining, marketing)

- 🔩 Metals (steel, aluminium, copper)

- 🧱 Cement & building materials

- 🧪 Chemicals & fertilisers

- ⚡ Power & energy utilities

Some well-known Indian names from these sectors often feature in this index, making it a collection of large, influential companies.

Note: Constituents are reviewed periodically. Always check the NSE Indices website for the latest list.

How Often Is the Index Reviewed?

NSE Indices reviews the nifty commodities index typically twice a year or whenever required.

During these reviews:

- New eligible stocks may be added

- Underperforming or less liquid stocks may be removed

- Weightages are adjusted

This ensures the index remains representative of the commodity sector.

Performance of Nifty Commodities Index Over Time

The performance of the nifty commodities index is closely linked to:

- Global commodity prices

- Demand from infrastructure and industry

- Government policies

- Economic cycles

Historically, the index tends to:

- Perform strongly during economic expansions

- Face pressure during slowdowns

- Show cyclical ups and downs

When metal prices surge or energy demand rises, the index often outperforms broader markets.

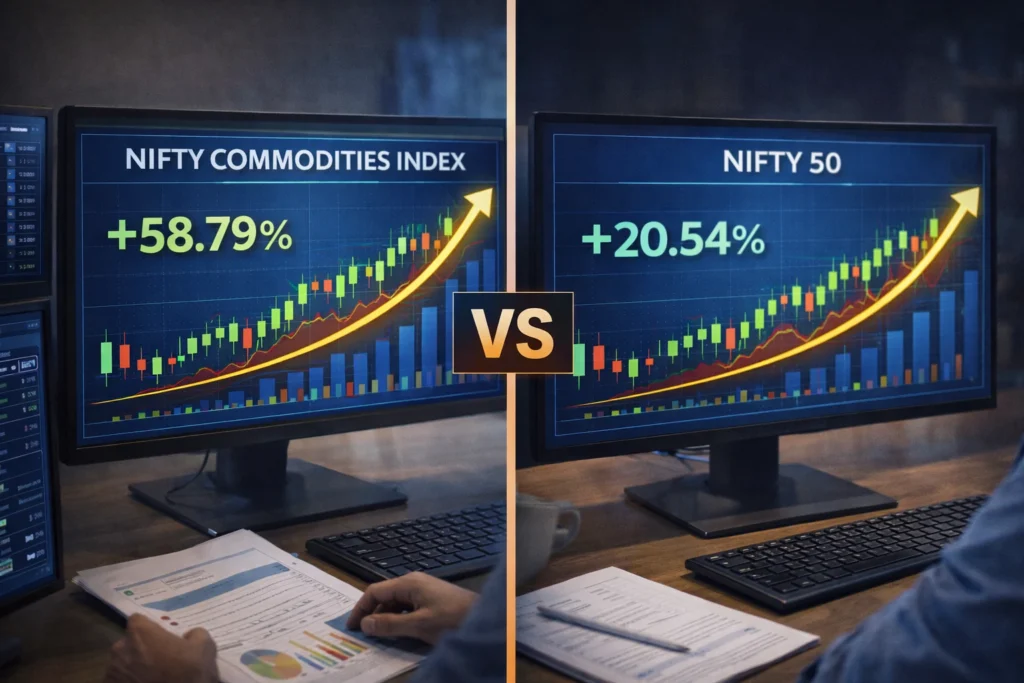

Nifty Commodities Index vs Broader Indices

Here’s how it compares with broader indices:

| Index | Focus | Risk | Nature |

|---|---|---|---|

| Nifty 50 | Large-cap across sectors | Moderate | Broad market |

| Nifty Midcap 150 | Mid-sized companies | Medium–High | Growth |

| Nifty Commodities Index | Commodity sectors | High | Cyclical |

The nifty commodities index is more sector-focused and cyclical than diversified indices.

Why Investors Track the Nifty Commodities Index

Investors follow this index because:

- It reflects industrial and infra momentum

- Offers sector-specific exposure

- Benefits from commodity price cycles

- Acts as hedge during inflation phases

For those bullish on infrastructure and manufacturing, the nifty commodities index becomes a key watch.

Risks of Investing in the Nifty Commodities Index

Commodity stocks carry specific risks:

- Highly cyclical earnings

- Dependence on global prices

- Impact of government regulations

- Volatility due to demand-supply changes

- Weather and geopolitical risks

This makes the index more volatile than diversified equity indices.

Who Should Invest in the Nifty Commodities Index?

This index may suit investors who:

- Believe in India’s infra and industrial growth

- Can handle cyclical ups and downs

- Want sector-specific exposure

- Already have diversified equity investments

- Have a medium to long-term horizon

It may not suit conservative investors seeking stable returns.

How Can You Invest in the Nifty Commodities Index?

You can’t buy the index directly, but you can invest through:

- Sectoral mutual funds tracking it

- ETFs linked to the index (if available)

- PMS or thematic portfolios

Availability depends on fund offerings in the market.

SIP vs Lump Sum in Sectoral Funds

Because sectoral indices can be volatile:

- SIP helps average cost over time

- Lump sum works better during deep corrections

- Discipline is key

Many investors prefer SIPs to manage cycles.

Taxation on Nifty Commodities Index Funds

Equity funds tracking this index follow standard equity taxation in India:

- Less than 1 year: 15% STCG

- More than 1 year: 10% LTCG above ₹1 lakh

Always check latest tax rules or consult a tax advisor.

How the Index Fits Into a Portfolio

The nifty commodities index can be used as:

- A satellite allocation for growth

- A hedge during inflationary phases

- A play on infra and manufacturing boom

But it should form only a part of a well-diversified portfolio, not the core.

Things to Check Before Investing

Before investing, consider:

- Your risk appetite

- Sector exposure already in portfolio

- Fund expense ratio

- Tracking error

- Market cycle position

Avoid chasing short-term rallies.

Common Myths About Commodity Stocks

(-ve) Commodity stocks always rise with inflation

(+ve) Not always. Cycles matter.

(-ve) Commodity companies are unsafe

(+ve) They’re cyclical, not unsafe.

(-ve) Sector funds guarantee higher returns

(+ve) Returns depend on timing and cycles.

Final Thoughts on Nifty Commodities Index

The nifty commodities index offers a window into India’s core industries that power growth – from steel and cement to oil and energy. It reflects the heartbeat of infrastructure, manufacturing, and development.

While it can deliver strong returns during upcycles, it also comes with sharp swings. For investors who understand cycles and want targeted exposure, the nifty commodities index can be a powerful addition to a diversified portfolio.

As always, patience, discipline, and balance remain the keys to success.

Reviewed for accuracy and last updated on December 26, 2025.