How to Trade in Sensex Options? A Simple Guide

If you want to profit from market moves without buying stocks, Sensex options can be a powerful tool. Many traders are now turning to Sensex options to take positions on India’s benchmark index with limited risk and flexible strategies.

In this guide, we explain how to trade in Sensex options, what they are, how they work, and what beginners should know before placing their first trade.

What Are Sensex Options?

Sensex options are derivative contracts based on the Sensex index of the Bombay Stock Exchange (BSE). They give the buyer the right, but not the obligation, to buy or sell the Sensex at a fixed price (called strike price) on or before a specific expiry date.

There are two types:

- Call option – You profit if Sensex goes up

- Put option – You profit if Sensex goes down

You don’t own any shares. You are only trading on the expected direction of the index.

Why Trade in Sensex Options?

Traders choose Sensex options because:

- Lower capital needed than futures

- Risk limited to premium paid (for buyers)

- Profit in rising and falling markets

- Ideal for short-term trading

- High liquidity in index options

For beginners, buying options is often safer than futures.

How Sensex Options Work

Each Sensex options contract has:

- Strike price – Price at which you can buy/sell

- Premium – Price you pay for the option

- Lot size – Fixed quantity per contract

- Expiry – Usually weekly or monthly

Example:

If Sensex is at 72,000 and you buy a 72,200 Call option at ₹100 premium, you pay ₹100 × lot size.

If Sensex moves above 72,300 (strike + premium), you start making profits.

Who Can Trade in Sensex Options?

You can trade Sensex options if you have:

- A trading & Demat account

- F&O (Futures & Options) segment activated

- Basic market knowledge

- Margin money for premiums

Most Indian brokers allow easy online access.

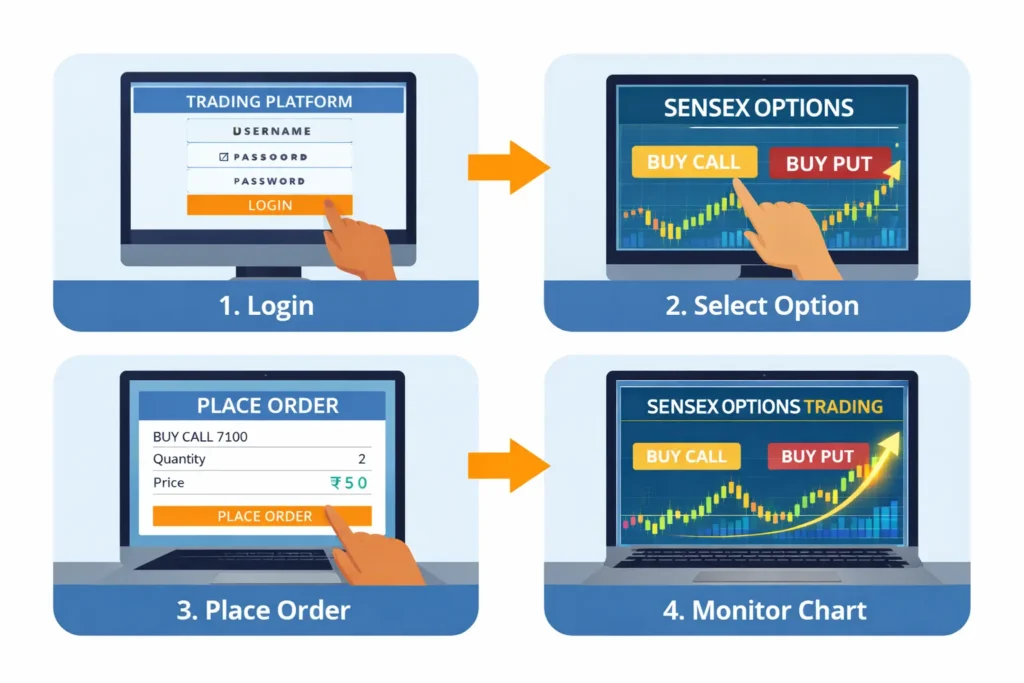

Step-by-Step: How to Trade in Sensex Options

Step 1: Open and Activate F&O Account

Choose a SEBI-registered broker and activate derivatives trading.

Step 2: Understand Market Direction

Use charts, news, and trends to decide if Sensex may rise or fall.

Step 3: Choose Call or Put

- Bullish? Buy Call

- Bearish? Buy Put

Step 4: Select Strike Price & Expiry

Pick based on your risk and view.

Step 5: Place the Trade

Enter quantity and confirm.

Step 6: Monitor and Exit

Book profits or cut losses before expiry.

Popular Sensex Options Trading Strategies

Buying Call Option

Used when expecting a sharp rise.

Buying Put Option

Used when expecting a fall.

Bull Call Spread

Buy lower strike call, sell higher strike call to reduce cost.

Protective Put

Buy put to hedge portfolio.

Beginners should start with simple buy strategies.

Sensex Options Lot Size and Expiry

Sensex options have a fixed lot size decided by the exchange. The contracts come with:

- Weekly expiry

- Monthly expiry (last Thursday)

Always check current lot size before trading, as it may change.

Risks of Trading Sensex Options

While options limit losses for buyers, risks remain:

- Premium can go to zero

- Time decay reduces option value

- Wrong direction = loss

- Emotional decisions hurt returns

Selling options carries unlimited risk and is not advised for beginners.

Tips for Beginners in Sensex Options

- Start with small trades

- Trade liquid strikes

- Use stop-loss

- Avoid overtrading

- Learn before scaling up

- Don’t chase losses

Discipline matters more than predictions.

Sensex Options vs Sensex Futures

| Sensex Options | Sensex Futures |

|---|---|

| Limited risk for buyers | Unlimited risk |

| Pay premium | Pay margin |

| Flexible strategies | Direct directional bet |

| Good for beginners | Better for experts |

Options offer more control over risk.

Costs and Taxes in Sensex Options

Costs:

- Brokerage

- Exchange fees

- GST, SEBI charges

- Stamp duty

Tax:

- Treated as business income

- Taxed as per slab

- Losses can be adjusted

Consult a tax expert for clarity.

Is Trading in Sensex Options Right for You?

Ask yourself:

- Can I handle losses?

- Do I understand options basics?

- Can I track markets daily?

- Do I follow a plan?

If yes, Sensex options may suit you. If not, learn more before trading live.

How Sensex Options Reflect Market Sentiment

Rising option volumes often show growing trader interest.

High put buying may signal fear, while call buying reflects optimism.

Many traders track open interest to judge market mood.

Final Thoughts: How to Trade in Sensex Options

To sum up, learning how to trade in Sensex options opens doors to advanced trading in India’s stock market. Options offer flexibility, limited risk (for buyers), and the chance to profit from both market directions.

But they are not shortcuts to quick money. Success comes from:

- Knowledge

- Practice

- Risk control

- Patience

Start small, keep learning, and trade wisely.

Reviewed for accuracy and last updated on December 24, 2025.