FD vs Savings Account: What’s the Difference?

If you have extra money in your savings account, the obvious question is: should it remain in the savings account or be transferred to a fixed deposit (FD)? In the year 2026, with inflation rates remaining high and interest rates fluctuating, the answer to this question will have a direct effect on how quickly your money will multiply and how easily you can withdraw it. Savings accounts provide immediate access to your money but earn you very little interest. FDs earn you higher interest but render your money inaccessible.

How This Comparison Helps Savers

This guide is meant to provide information on the differences between fixed deposits and savings accounts with respect to returns, liquidity, taxation, and usage. The purpose of this guide is to educate readers on how these two instruments work, and not to offer any financial advice.

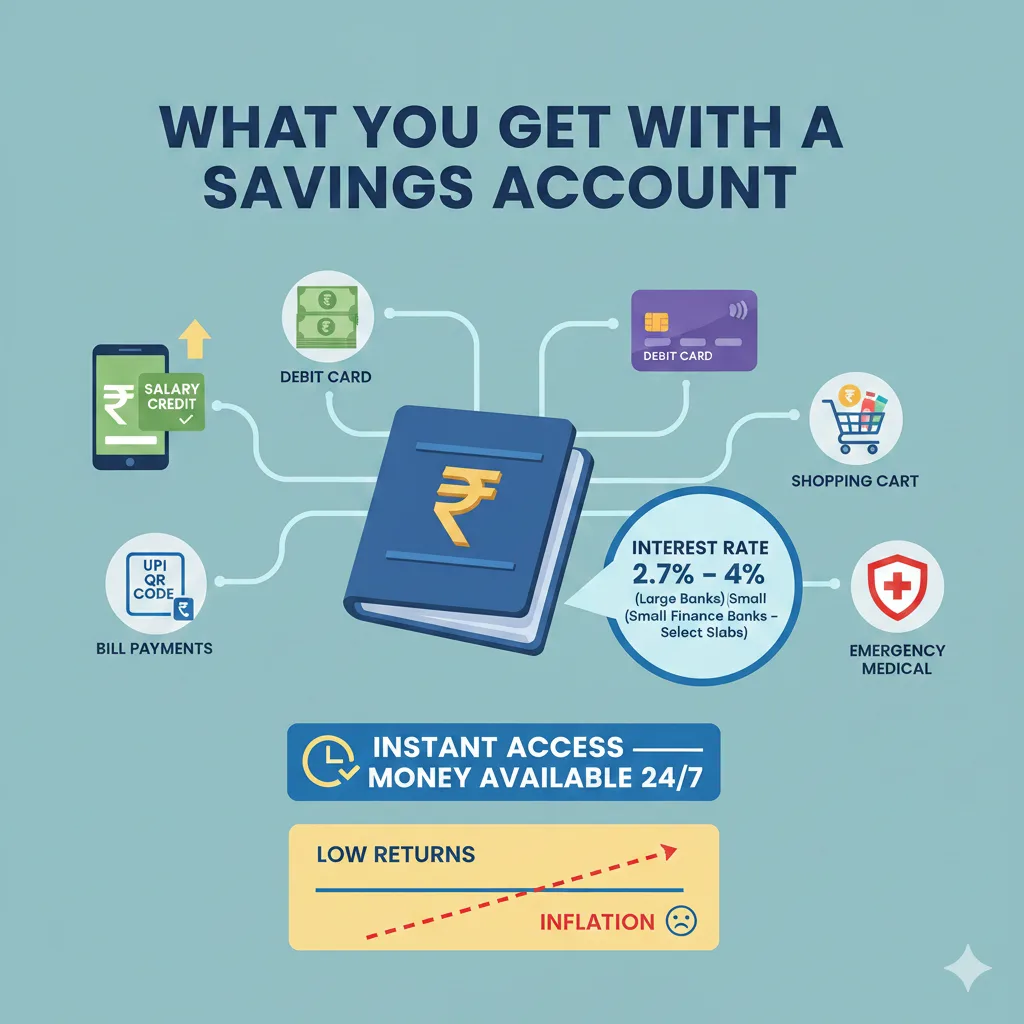

What You Get With a Savings Account

A savings account is built for daily life.

You use it for:

- Salary credits

- UPI and debit card payments

- Bills and shopping

- Emergencies

In 2026, most large banks offer 2.7%-4% interest. Some small finance banks go up to 7% on select slabs.

The biggest advantage is instant access. Your money is available 24/7.

But the trade-off is clear: returns are low and often fail to beat inflation.

What You Get With a Fixed Deposit (FD)

An FD locks a lump sum for a fixed period-3 months, 1 year, or 3 years.

In return, banks pay higher interest:

- Public banks: 6%-7.25%

- Private banks: 6.5%-7.75%

- Seniors: 0.25%-0.75% extra

FDs offer:

- Predictable returns

- Low risk

- Better growth than savings accounts

The downside? You lose flexibility. Early withdrawal usually means a penalty and lower interest.

FD vs Savings Account: Quick Comparison

| Feature | Savings Account | Fixed Deposit |

|---|---|---|

| Interest | 2.7%-4% (up to 7% in small banks) | 6%-7.75% |

| Liquidity | Instant | Locked (penalty on early break) |

| Risk | Very low | Very low |

| Best for | Daily use, emergency fund | Parking surplus cash |

| Tax | Interest taxable (₹10k deduction) | Interest taxable + TDS |

Where Does Your Money Grow Faster?

Put ₹2,00,000 aside for one year:

- Savings account @ 3.5% -> ₹7,000 interest

- FD @ 7% -> ₹14,000 interest

FD nearly doubles your return.

But if you break the FD early, banks cut the rate and charge a penalty. FDs work best when you’re sure you won’t need the money soon.

Liquidity: The Savings Account Advantage

Emergencies don’t wait.

Medical bills, sudden travel, or job gaps need instant cash. A savings account lets you withdraw via ATM, UPI, or branch-no friction.

That’s why planners suggest keeping 3-6 months of expenses in a savings account (or liquid fund). Don’t lock emergency money in long FDs.

Tax: The Part Many Ignore

Both products are taxable:

- Savings account:

- ₹10,000 interest deduction under Section 80TTA (₹50,000 for seniors under 80TTB).

- FD:

- No blanket exemption.

- Banks deduct TDS at 10% if interest crosses ₹40,000 (₹50,000 for seniors).

Your real return depends on your tax slab. A 7% FD can drop below inflation after tax.

When a Savings Account Is Better

Use a savings account for:

- Salary and monthly expenses

- Emergency fund

- Short-term needs (0–3 months)

- Frequent transactions

Tip: Consider a high-interest savings account for your emergency fund to earn more without losing access.

When an FD Is Better

Choose an FD if:

- The money is surplus

- You won’t need it for 6-36 months

- You want predictable returns

- You prefer zero market risk

FDs are ideal for:

- Parking money before big expenses

- Conservative investors

- Retirees seeking stability

The Smart 2026 Strategy: Use Both

Don’t pick one-combine them.

- Keep 3-6 months of expenses in savings

- Move surplus into short-term FDs

- Ladder FDs (3, 6, 12 months)

- Review rates yearly

You get liquidity and better returns.

For long-term growth beyond FDs, learn how compounding works in SIP Explained Simply: How Monthly Investing Works.

What Regulators Say

The RBI advises depositors to understand terms, premature withdrawal rules, and insurance. All bank deposits are insured up to ₹5 lakh per bank.

Official guidance: https://www.rbi.org.in/

Conclusion

In 2026, the FD vs savings account choice depends on purpose:

- Savings account = access and safety for daily life

- FD = higher returns for idle cash

The smartest savers don’t choose one-they balance both. Keep emergencies liquid. Put surplus to work.

Written By Nakul

Disclaimer

This article is published for informational and educational purposes only and does not constitute financial, investment, or legal advice. Interest rates, tax laws, and banking regulations are subject to change over time and may differ from bank to bank and from person to person. Readers should check the current terms with their bank or with a financial advisor before making any financial decisions.

Reviewed for accuracy and last updated on February 1, 2026.