How Credit Card Interest Is Calculated in India

Credit cards are very convenient, but they can be costly if you do not know how interest rates work. Many Indians have been shocked when a small unpaid bill has turned into a large amount in a short period of time. This is because credit card interest rates in India are calculated on a daily basis and charged on a monthly basis, often ranging between 30% and 45% per annum. In 2026, when more Indians will be using credit cards for their day-to-day transactions, it is important to know how credit card interest rates are calculated.

What Is Credit Card Interest?

Credit card interest is the cost you pay for borrowing money from the bank.

If you pay your full bill before the due date, you pay zero interest.

If you pay only the minimum due or carry a balance, interest is charged on the unpaid amount.

Unlike personal loans, credit cards use:

- Daily interest calculation

- Monthly compounding

This is why balances grow fast.

The Interest Rate You’re Actually Paying

Most Indian cards show interest like this:

- 3% to 3.75% per month

- Which equals 36% to 45% per year

This rate applies to:

- Unpaid purchase amounts

- Cash withdrawals

- EMIs that are not “no-cost”

It starts from the transaction date, not the bill date.

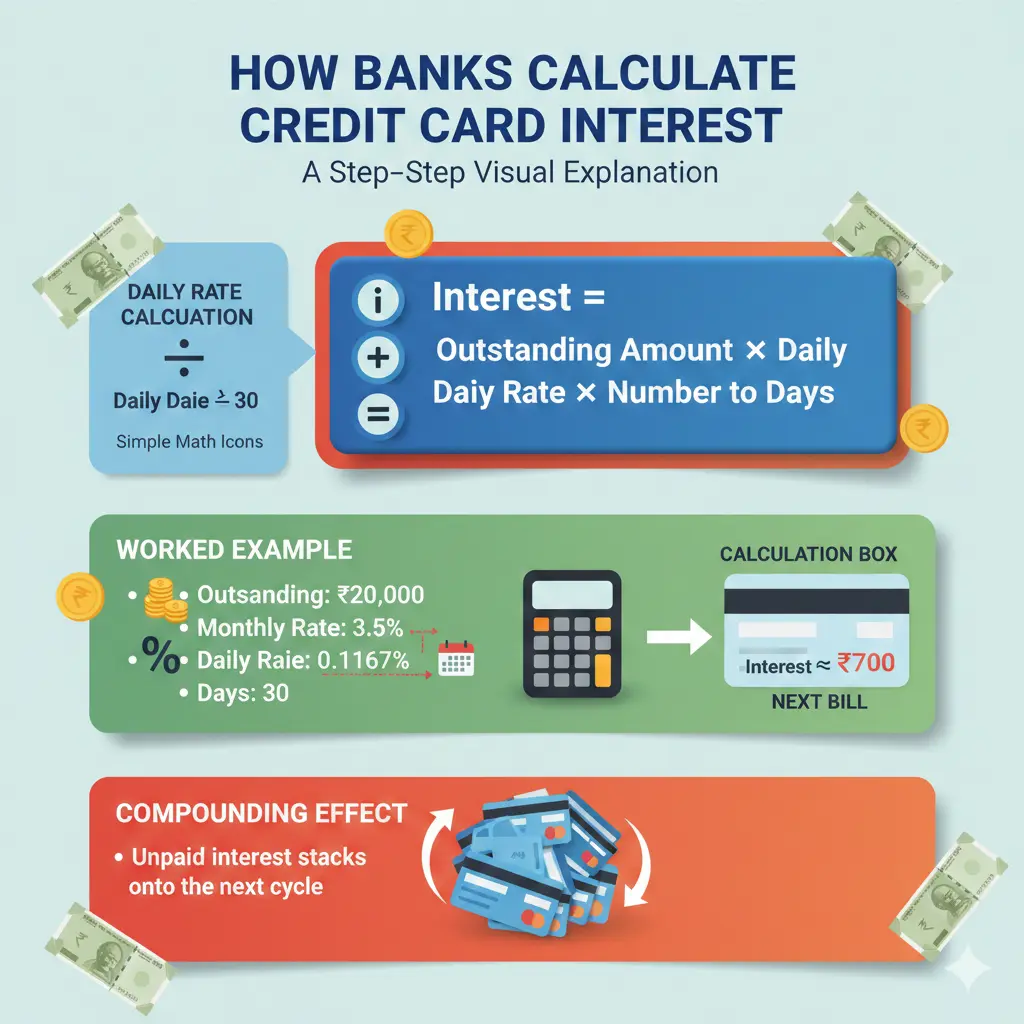

How Banks Calculate Credit Card Interest

Banks use this simple formula:

Interest = Outstanding Amount × Daily Rate × Number of Days

Where:

- Daily Rate = Monthly Rate ÷ 30

Example:

- Outstanding: ₹20,000

- Monthly rate: 3.5%

- Daily rate: 0.1167%

- Days carried: 30

Interest = ₹20,000 × 0.001167 × 30

= ₹700 (approx)

This ₹700 is added to your next bill. If you don’t pay it fully, interest is charged again on this new total.

That’s compounding.

What Happens If You Pay Only Minimum Due?

Let’s say your bill is ₹25,000.

- Minimum due: ₹1,250

- You pay only ₹1,250

- Remaining: ₹23,750

Interest is now charged on ₹23,750, not on ₹25,000.

But here’s the catch:

- New purchases lose the interest-free period

- Interest applies to everything from day one

This is called loss of grace period.

From that point, every swipe starts costing interest immediately.

Real-Life Example

Ravi spends ₹30,000 on his card.

- Due date arrives

- He pays only ₹2,000

- Balance left: ₹28,000

At 3.5% monthly:

Interest for one month ≈ ₹980

New balance = ₹28,980

Next month, if he again pays minimum:

Interest applies on ₹28,980

Balance grows again

Within 6 months, Ravi ends up paying thousands in interest-even without spending more.

Cash Withdrawals: The Most Expensive Move

Withdrawing cash from a credit card is costliest:

- Cash withdrawal fee: 2.5%–3%

- Interest starts immediately

- No interest-free period

- Higher effective rate

A ₹10,000 cash withdrawal can cost you ₹300 upfront and hundreds more in interest.

Avoid it unless it’s an emergency.

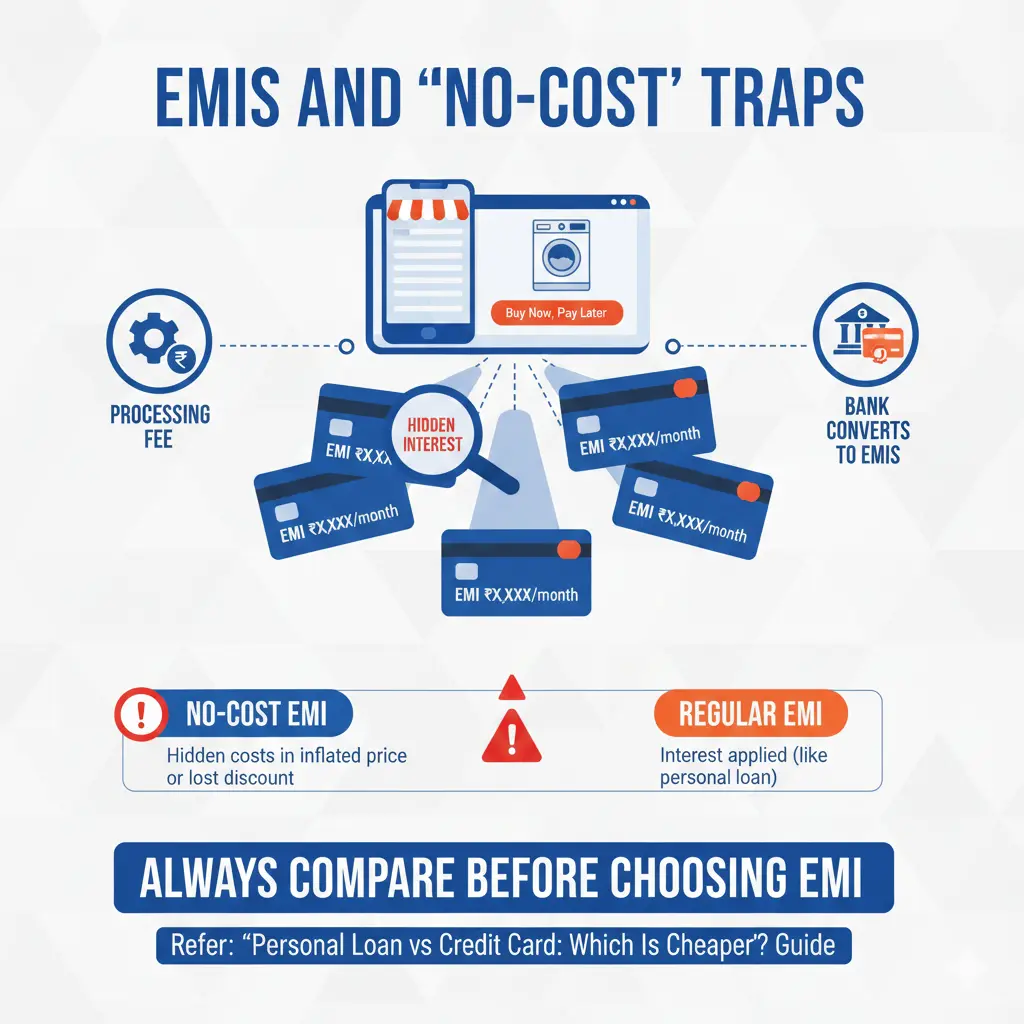

EMIs and “No-Cost” Traps

Many purchases offer “No-Cost EMI”. What happens:

- Bank converts purchase into EMIs

- Interest is hidden in product price or discount

- Processing fee may apply

Regular EMIs, however, carry interest similar to personal loans.

Before choosing EMI, compare with our guide: Personal Loan vs Credit Card: Which Is Cheaper?

Charges That Add to Your Interest Burden

Besides interest, cards charge:

| Charge | Typical Amount |

|---|---|

| Late payment fee | ₹500-₹1,300 |

| Over-limit fee | ₹500-₹1,000 |

| GST on interest | 18% |

| Cash advance fee | 2.5%-3% |

These add up quickly.

How to Avoid Paying Credit Card Interest

- Pay full bill every month

- Set up auto-debit

- Keep usage under 30% of limit

- Avoid cash withdrawals

- Don’t roll balances

- Use EMI only when needed

If you’re new to cards, read Best Credit Cards in India for Beginners (2026) to choose safer options.

Why This Matters for Indian Users

With rising digital payments and easy approvals, more Indians are getting cards.

But:

- Interest rates are among the highest in retail finance

- Lack of awareness causes debt traps

- Many users don’t understand daily compounding

Knowing how interest works turns your card into a tool-not a trap.

What Regulators Say

The Reserve Bank of India (RBI) asks banks to clearly disclose interest rates and charges. Consumers are advised to read the Most Important Terms and Conditions (MITC) of their card.

Official guidance:

https://www.rbi.org.in/

Conclusion

Credit card interest in India is powerful because it’s calculated daily and compounded monthly. A small unpaid amount can snowball into a big burden.

The rule is simple:

- Pay in full, pay zero

- Pay partially, pay heavily

Understanding this math can save you thousands every year and keep your financial life stress-free.

Written By Nakul

Disclaimer:

This article is for informational and educational purposes only and does not constitute financial, legal, or professional advice. Credit card terms, interest rates, and charges may vary by bank and can change over time. The examples used are illustrative and may not reflect your exact billing cycle or card agreement. Readers should refer to their card’s Most Important Terms and Conditions (MITC) and statements, or contact their bank for precise details. The author and publisher are not responsible for any financial decisions or losses arising from reliance on this content. Always verify information with official sources before acting.

Reviewed for accuracy and last updated on February 1, 2026.