Nifty Microcap 250 Index: A Guide to India’s Smallest Stocks

The nifty microcap 250 index is quickly gaining attention among investors hunting for the next big growth stories in India. The index tracks the performance of the smallest listed companies that often operate under the radar but can deliver powerful returns over time.

In this article, we explain what the nifty microcap 250 index is, how it works, the type of companies it includes, its performance, risks, and how you can use it wisely as part of a diversified portfolio.

What Is the Nifty Microcap 250 Index?

The nifty microcap 250 index is an index maintained by NSE Indices that tracks the performance of 250 micro-cap companies listed on the National Stock Exchange (NSE).

These companies are ranked below small-cap stocks in terms of market capitalisation. They are usually early-stage or niche players with small revenues but ambitious growth plans.

In simple words, the nifty microcap 250 index shows how India’s smallest listed companies are performing.

Why Microcaps Matter in India’s Market

Microcap companies often represent:

- Early-stage businesses

- Niche manufacturing or services firms

- Emerging sector players

- Potential future small- or mid-cap leaders

They reflect the grassroots level of India’s economy. When microcaps do well, it often signals rising risk appetite and optimism about future growth.

How Is the Nifty Microcap 250 Index Constructed?

The index is created from eligible NSE-listed stocks based on:

- Free-float market capitalisation

- Liquidity and trading frequency

- Exclusion of large, mid, and small caps

- Compliance with NSE rules

Like other NSE indices, it follows the free-float market cap method, ensuring that only publicly traded shares affect index movement.

This structure makes it suitable for index funds and ETFs.

What Kind of Companies Are in the Index?

The stocks in the nifty microcap 250 index span multiple sectors, including:

- Specialty chemicals

- Engineering & capital goods

- Textiles & manufacturing

- Consumer products

- Pharmaceuticals

- Small IT & digital firms

- Auto ancillaries

These companies are often less known but deeply connected to domestic demand and supply chains.

Constituents change periodically. Always refer to the NSE Indices website for the latest list.

How Often Is the Index Reviewed?

The nifty microcap 250 index is usually reviewed twice a year by NSE Indices.

During these reviews:

- Fast-growing firms may be added

- Illiquid or weaker stocks may be removed

- Weightages are adjusted

This keeps the index aligned with current leaders in the microcap space.

Performance of Nifty Microcap 250 Index Over Time

Historically, microcap stocks in India have shown:

- Explosive rallies during strong bull markets

- Deep corrections during market downturns

- Very high volatility

The nifty microcap 250 index can deliver extraordinary returns in favourable conditions, but it can also test investor patience during rough phases.

This makes it strictly a long-term and high-risk segment.

Nifty Microcap 250 Index vs Other Indices

To understand its position, compare it with other segments:

| Index | Segment | Risk | Growth Potential |

|---|---|---|---|

| Nifty 50 | Large-cap | Low | Moderate |

| Nifty Midcap 150 | Mid-cap | Medium | High |

| Nifty Smallcap 250 Index | Small-cap | High | Very High |

| Nifty Microcap 250 Index | Microcap | Very High | Extreme |

Each layer adds more growth – and more risk.

Why Investors Track the Nifty Microcap 250 Index

Investors follow the nifty microcap 250 index because:

- It captures early growth stories

- Gives exposure to future leaders

- Reflects risk appetite in the market

- Offers diversification beyond large and midcaps

However, it’s usually used as a small part of a portfolio, not the core.

Risks of Investing in Nifty Microcap 250 Index

Microcaps carry the highest risk among equity segments:

- Sharp and sudden price swings

- Low liquidity in many stocks

- High impact of negative news

- Business and governance risks

- Emotional stress during volatility

Losses can be severe if markets turn.

Who Should Invest in the Nifty Microcap 250 Index?

The index may suit investors who:

- Have high risk tolerance

- Can invest for 10+ years

- Already hold large, mid, and small caps

- Want aggressive growth exposure

- Can stay calm during big drawdowns

For conservative investors, this segment is usually not recommended.

How Can You Invest in Nifty Microcap 250 Index?

You can’t buy the index directly, but exposure is possible through:

- Index mutual funds (if available)

- ETFs tracking the index

- PMS or AIF strategies

Availability may be limited as microcap indices are newer.

SIP vs Lump Sum in Microcap Indices

Because of wild volatility, most experts suggest:

- Using SIP to average costs

- Avoiding large lump sum entries at highs

- Staying disciplined through cycles

SIP reduces timing risk but doesn’t remove volatility.

How Nifty Microcap 250 Fits Into a Portfolio

A layered portfolio approach often looks like:

- Large caps for stability

- Midcaps for growth

- Small caps for higher returns

- Microcaps for aggressive upside

At this stage, you can naturally link your clusters:

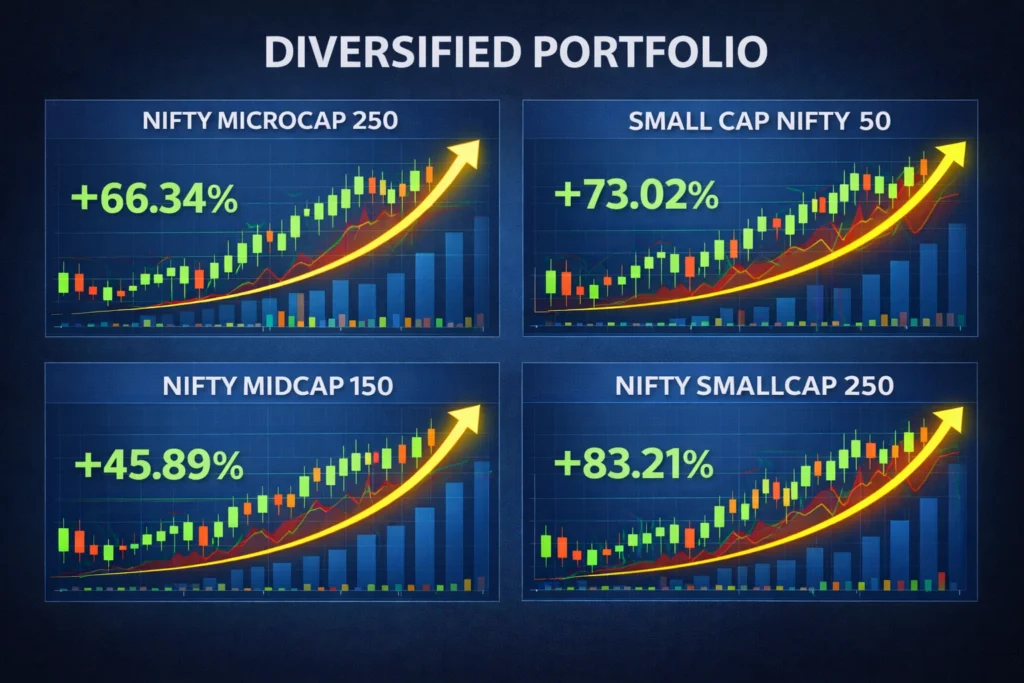

To balance your portfolio, consider pairing microcap exposure with Nifty Midcap 150 for stability and Small Cap Nifty 50 for focused small-cap growth.

And for a broader small-cap universe:

You can also explore Nifty Smallcap 250 Index to understand how the wider small-cap segment performs.

Taxation on Microcap Index Funds

If you invest through equity funds tracking the index:

- < 1 year: 15% short-term capital gains tax

- > 1 year: 10% LTCG above ₹1 lakh

Tax rules may change. Always verify with latest guidelines.

Things to Check Before Investing

Before adding microcaps, consider:

- Your risk appetite

- Portfolio balance

- Fund liquidity

- Expense ratio

- Time horizon

Never invest money you may need soon.

Final Thoughts on Nifty Microcap 250 Index

The nifty microcap 250 index offers a window into India’s smallest and most ambitious companies. It represents raw growth potential at the grassroots level of the economy.

But with that potential comes extreme volatility and risk. For seasoned, patient investors who already have exposure to larger segments, a small allocation to the nifty microcap 250 index can add punch to long-term returns.

For most others, it’s better to first build a solid base with large, mid, and small caps before venturing into microcaps.

Reviewed for accuracy and last updated on December 26, 2025.