How to Start SIP With ₹10,000 Per Month in India

How to Start SIP (Systematic Investment Plan) has become one of the most popular investment methods in India-and for good reason. It allows even small investors to create wealth gradually without worrying about market timing.

If you’re wondering how to start SIP with ₹10,000 per month, this guide will walk you through everything-step by step-using simple language and practical examples.

Whether you’re a beginner, salaried professional, or self-employed, ₹10,000 per month is a solid starting amount that can deliver impressive long-term results.

What Is SIP and Why Is It Popular?

A Systematic Investment Plan (SIP) is a way to invest a fixed amount in mutual funds at regular intervals (monthly, quarterly, etc.).

Why SIP Works Well for Indians:

- You don’t need large capital

- Fits monthly salary cycle

- Reduces market timing risk

- Encourages financial discipline

- Power of compounding works best over time

SIP is ideal for long-term goals like retirement, children’s education, or wealth creation.

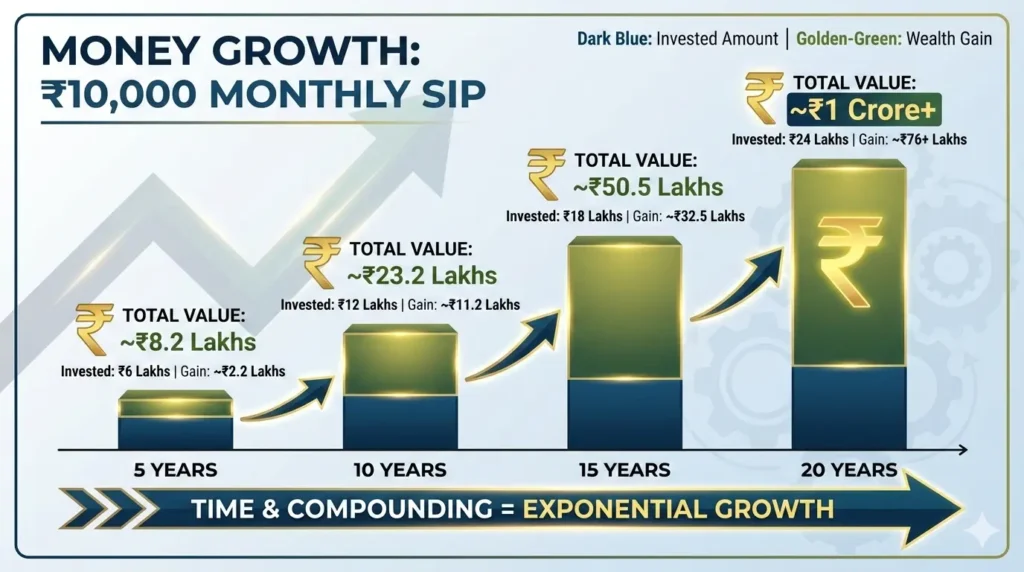

What Can ₹10,000 SIP Grow Into?

Let’s look at real numbers assuming 12% average annual returns (historical equity mutual fund average).

₹10,000 Monthly SIP Returns

| Time Period | Total Invested | Expected Value |

|---|---|---|

| 5 Years | ₹6,00,000 | ₹8.2 lakh |

| 10 Years | ₹12,00,000 | ₹23 lakh |

| 15 Years | ₹18,00,000 | ₹50 lakh |

| 20 Years | ₹24,00,000 | ₹1 crore+ |

This shows how small monthly investments can create big wealth.

Step-by-Step: How to Start SIP With ₹10,000

Step 1: Define Your Goal

Before investing, ask:

- Why am I investing?

- For how long?

- How much risk can I take?

Examples:

- Retirement → Long-term (15-25 years)

- House down payment → Medium-term (5-7 years)

- Child education → Long-term (10-15 years)

Step 2: Decide SIP Allocation

Instead of investing 10K in one Fund Contact Amfi Registered Mutual Fund Distributor For Diversified Portfolio .

Ideal SIP Allocation for Beginners

| Fund Type | Monthly Amount |

|---|---|

| Large Cap / Index Fund | ₹4,000 |

| Flexi Cap / Multicap | ₹3,000 |

| Mid Cap Fund | ₹2,000 |

| Debt / Hybrid Fund | ₹1,000 |

- Balanced growth

- Lower volatility

- Suitable for Indian investors

Step 3: Choose the Right Mutual Funds

You don’t need 10 funds. 3-4 good funds are enough.

Popular Mutual Fund Categories (Educational Only)

- Index Funds – Nifty 50, Sensex

- Large Cap Funds – Stable returns

- Flexi Cap Funds – Flexible across market caps

- Hybrid Funds – Lower risk

Always check:

- Expense ratio

- Fund manager track record

- Fund performance over 5-10 years

Step 4: Complete KYC

To start SIP, you must complete Mutual Fund KYC.

Documents required:

- PAN Card

- Aadhaar Card

- Bank Account

- Mobile number & email

KYC can be done:

- Online via AMC websites

- With a mutual fund distributor

Step 5: Start SIP Online

You can start SIP easily using:

- Mutual Fund Apps

- AMC official websites

- Banks

- Registered Investment Advisors

Choose:

- SIP date (after salary credit date)

- Auto-debit via mandate

- Monthly frequency

So once sip started set Autopay Mandate

Best SIP Date: When Should You Invest?

There is no perfect SIP date. Market ups and downs average out over time.

Tip:

Choose a date 5–7 days after salary credit to avoid missed SIPs.

Common Mistakes to Avoid

(X) Stopping SIP during market fall

(X) Choosing funds based on last year returns

(X) Investing without a goal

(X) Too many funds

(X) Panic switching funds

Remember: Time in the market beats timing the market.

Should You Increase SIP Over Time? (Very Important)

Yes! This is called Step-Up SIP.

Example:

- Year 1: ₹10,000/month

- Increase by 10% every year

Result:

- Much higher final corpus

- Easy on monthly budget

Even a small yearly increase makes a huge difference.

Is SIP Safe? What Are the Risks?

- SIP is not risk-free

- Returns depend on market performance

- Short-term volatility is normal

However:

* Long-term SIP (10+ years) significantly reduces risk

* Equity SIPs historically outperform inflation

Taxation on SIP Investments

Equity Mutual Funds:

- Holding > 1 year → LTCG tax 10% (above ₹1 lakh)

- Holding < 1 year → STCG tax 15%

ELSS SIP:

- Tax saving under Section 80C (₹1.5 lakh)

- Lock-in of 3 years

Who Should Start SIP With ₹10,000?

* Salaried professionals

* Young investors (20–40 age group)

* First-time investors

* Anyone wanting disciplined investing

Expert Tip: Review SIP Once a Year

- Check fund performance

- Rebalance if needed

- Increase SIP amount

- Avoid frequent changes

Final Verdict

Starting SIP with ₹10,000 per month is one of the smartest financial decisions you can make today.

You don’t need market expertise, large capital, or perfect timing. All you need is:

- Discipline

- Patience

- Long-term mindset

Start early, stay invested, and let compounding do the heavy lifting.

Want a custom SIP plan based on your age, income, and goals?

Fill This Persona Form : Google Form

I’ll create a personalized SIP allocation for you.

Reviewed for accuracy and last updated on January 20, 2026.