Mutual funds have become one of the most popular investment options in India especially for beginners who want to invest but don’t know where to start. They offer an easy pathway to build wealth, grow savings, and participate in the stock market without needing expert-level knowledge.

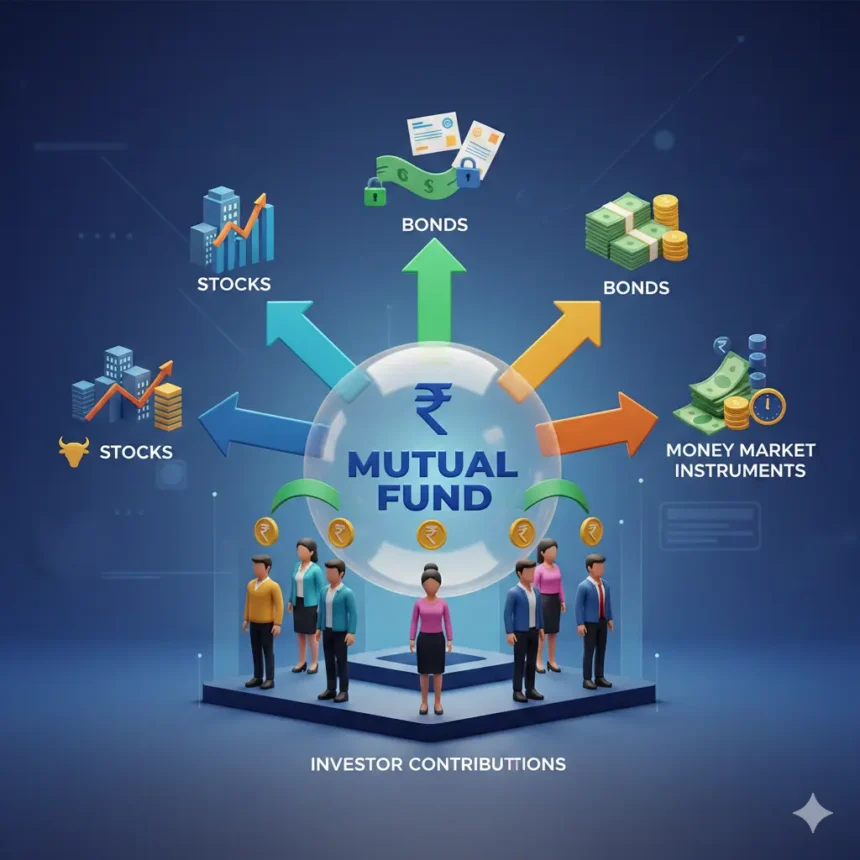

In simple terms, mutual funds are investment vehicles that pool money from multiple investors and invest it across different asset classes such as equity (stocks), debt (bonds), and money market instruments. This pooled structure keeps investing affordable, diversified, and professionally managed.

And here’s the interesting part: you’re not investing in the mutual fund itself you’re investing through it.

Let’s break everything down step by step so you understand mutual funds like a pro.

What Are Mutual Funds and How Do They Work?

When you invest in a mutual fund, your money is combined with thousands of other investors’ money. This large pool is managed by a professional fund manager working at an Asset Management Company (AMC).

The AMC invests this money according to the fund’s objective whether it aims for long-term growth, stability, regular income, or a mix of all three.

Here’s how the process works:

1. Pooling of Money

Investors invest money into a mutual fund scheme. All the funds collected are pooled together.

2. Allocation of Units

Based on the invested amount and the day’s NAV (Net Asset Value), investors receive units of the mutual fund.

3. Earning Returns

Investors earn through:

- Income (dividends or interest)

- Capital appreciation, which is the increase in NAV over time

You realise capital gains only when you redeem your units.

Let’s Understand Mutual Funds Through an Example

Imagine you want to invest in the top 50 companies listed on the NSE such as Reliance, Infosys, HDFC Bank, TCS, and more. Buying 50 individual stocks would require a big investment, plus the time and expertise to research each company.

But there’s a simple shortcut:

💡 Invest in a Nifty 50 Index Fund, like the Groww Nifty 50 Index Fund.

This fund automatically invests in all the companies that make up the Nifty 50 index in the same proportion. So with just one investment, you get exposure to the entire basket of stocks.

How Are Mutual Fund NAVs Calculated?

NAV stands for Net Asset Value, and it represents the value of each unit of a mutual fund. NAV changes daily based on market movements.

Formula for NAV:

NAV per unit = (Total Assets − Total Liabilities) / Total Outstanding Units

Let’s take an example:

The mutual fund holds:

- ₹50 crore in stocks

- ₹10 crore in bonds

- ₹2 crore in cash

- ₹1 crore in receivables

- ₹3 crore in liabilities

- 6 crore units in total

NAV = (50 + 10 + 2 + 1 – 3) / 6

NAV = ₹10 per unit

If the value of underlying investments rises, the NAV rises; if they fall, the NAV decreases.

Read Also : Best Wealth Plan for Couples Earning ₹1 Lakh to ₹2 Lakhs Monthly in India.

How Can You Invest in Mutual Funds?

You can start investing in mutual funds in two ways:

1. SIP (Systematic Investment Plan)

A SIP allows you to invest regularly monthly, quarterly, or yearly. This is ideal for beginners, salaried individuals, and long-term goals.

2. Lump Sum Investment

A one-time investment, like ₹10,000 or any preferred amount.

Before Investing, Consider These Key Factors

To choose the right mutual fund, you must understand:

✔ Your Financial Goals

- Wealth creation

- Retirement planning

- Buying a house

- Children’s education

- Taxes savings

✔ Your Risk Appetite

Market investments fluctuate. Decide how much short-term volatility you can handle.

✔ Investment Duration

Long-term investments generally give better returns.

Investments can be made directly via AMCs or through platforms like Groww, banks, or distributors.

Role of an Asset Management Company (AMC)

An AMC is the backbone of the mutual fund industry. Its responsibilities include:

- Launching new investment schemes

- Managing investors’ money based on the scheme objective

- Ensuring compliance and smooth functioning

- Hiring expert fund managers

Some well-known AMCs include:

HDFC AMC, ICICI Prudential, SBI Mutual Fund, Nippon India, and more.

Types of Mutual Funds in India

Mutual funds come in many categories based on where they invest:

1. Equity Funds

Invest in company stocks.

Risk Level: Very High

Ideal for long-term growth.

2. Debt Funds

Invest in bonds, government securities, and corporate debt.

Risk Level: Lower

Ideal for stability and income.

3. Hybrid / Balanced Funds

Mix of equity and debt.

Risk Level: Moderate

Ideal for balanced investors.

4. Index Funds

Track an index like Nifty 50 or Sensex.

Risk Level: Moderate

5. ETFs (Exchange Traded Funds)

Trade like stocks on exchanges.

Risk varies based on underlying assets.

6. Fund of Funds (FoFs)

Invest in other mutual funds.

Risk depends on underlying schemes.

Benefits of Investing in Mutual Funds

Mutual funds offer several advantages:

✔ Professional Fund Management

Experts manage your money using research and analysis.

✔ Diversification

Your money spreads across many stocks or bonds, reducing risk.

✔ Invest with Just ₹100

Even small investors can start easily.

✔ Liquidity

Redeem units anytime (except ELSS which has lock-in).

✔ Tax Benefits

ELSS funds offer tax deduction up to ₹1.5 lakh under Section 80C (old tax regime).

Risks of Mutual Funds

While mutual funds offer benefits, there are risks too:

No Guaranteed Returns

Market fluctuations affect NAV.

Choosing the Right Scheme is Difficult

Over 4,000 schemes in India.

Expense Ratio Reduces Returns

Higher expenses = lower net returns.

Fees Charged by Mutual Funds

1. Expense Ratio

The annual fee charged by the AMC for managing your money.

2. Exit Load

Charged if you redeem units before the specified holding period, usually 1%.

Who Should Invest in Mutual Funds?

You should consider mutual funds if:

- You’re a beginner and want to start with small amounts (₹100 SIP)

- You don’t have time to track the stock market

- You want professional management

- You’re investing for long-term goals

- You want tax benefits through ELSS

Mutual Funds vs Other Investment Options

Mutual Funds vs Fixed Deposits (FDs)

| Parameter | Mutual Funds | FDs |

|---|---|---|

| Returns | Market-linked | Fixed |

| Risk | Moderate | Very Low |

| Liquidity | High | Low |

| Taxation | Depends on category | Based on income slab |

| Ideal For | Higher returns with some risk | Safe capital protection |

Mutual Funds vs Stocks

| Parameter | Mutual Funds | Stocks |

|---|---|---|

| Nature | Diversified | Single company |

| Risk | Medium | High |

| Liquidity | Moderate | Very High |

| Management | Professional | Self-managed |

| Diversification | High | Low |

Mutual Fund Glossary: Important Terms You Must Know

Here are some key terms used in mutual funds:

- AMC – Asset Management Company

- AUM – Assets Under Management

- ELSS – Equity Linked Savings Scheme

- SIP – Systematic Investment Plan

- NAV – Net Asset Value

- Benchmark – Index used for performance comparison

- Expense Ratio – Annual fee charged by AMC

- Exit Load – Fee for early redemption

- Gilt Funds – Invest in government securities

- Large Cap, Mid Cap, Small Cap – Based on company size

- NFO – New Fund Offer

- Redemption – Selling units

- Portfolio – All investments held by a fund

- XIRR – Method to calculate SIP returns

- SWP – Systematic Withdrawal Plan

(This is only a portion the full glossary is kept intact as provided by you.)

Conclusion

Mutual funds are one of the smartest ways to invest in today’s financial landscape. Whether you’re new to investing or already experienced, mutual funds offer something for every type of investor. With professional management, diversification, tax benefits, and flexibility, they serve as a powerful tool for long-term wealth creation.

Start small, stay consistent, and let the power of compounding work for you.

Reviewed for accuracy and last updated on December 13, 2025.