Financial planning is a must for couples these days. The cost of living is increasing, medical expenses are becoming unexpectedly heavy. There are many hopes for children’s education and future. In this situation, earning ₹1 lakh–₹2 lakh per month is not enough.

Managing that money properly is the real wealth creation. With the right strategy, it is possible for even a couple with this income to accumulate more than ₹11 crore by the time of retirement. That is the path to wealth that I am going to show you now.

Establish the necessary security first

Before starting investments, you should make sure that your family is financially protected.

Your top priorities should be:

*Home Loan EMI / Rent Planning. *Emergency Fund. *Children’s Future Education Fund. *Personal Health Insurance. * Insurance

Many employees feel safe because they have company insurance. But that insurance also ends the day they leave their job.

That’s why personal health insurance is a must for you and your family

Why term insurance? Even if your income stops… your responsibilities don’t stop!

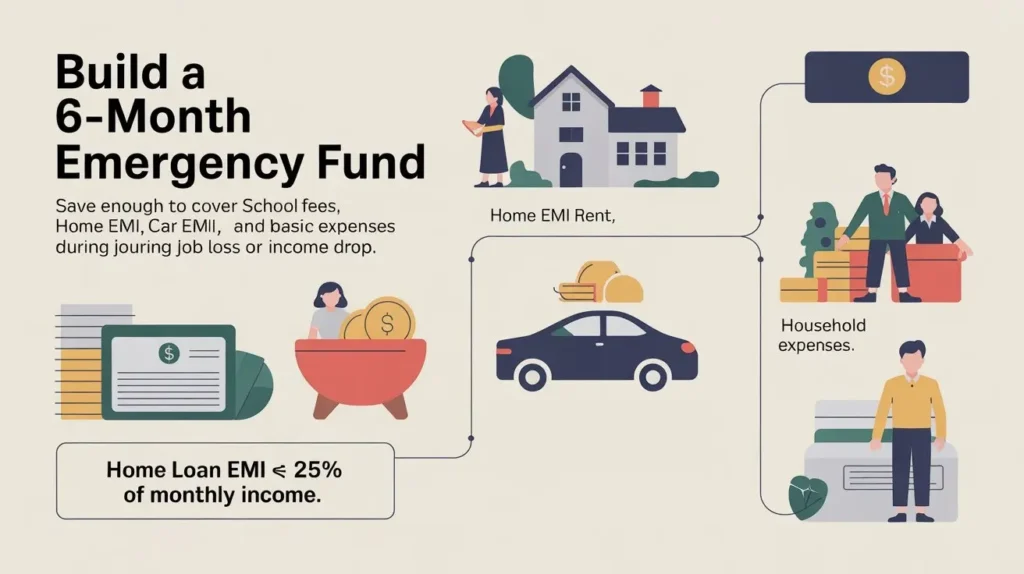

Prepare an emergency fund that is enough for 6 months

You never know when unexpected situations will arise.So, you should keep an emergency fund that is enough for 6 months of expenses separately.

It should include:

*Children’s school fees *Home loan EMI or rent *Car loan EMI *Fixed household expenses

It protects you from having to touch your investments during an emergency.

A golden rule:

Home loan EMI = < 25% of total income only

This will balance your budget.

Keep monthly expenses under control

An important rule if you are under 32 years of age

Monthly expenses = 60% of total income only

Example:

Monthly income = ₹1,50,000

That means expenses should be < ₹90,000

Then you would have available for investments:

₹60,000 / month

As investment capacity increases

Wealth grows faster.

Your savings percentage is more important than your income!

Things to note

✔ Update your goals based on inflation

✔ Tax + cess will apply if you redeem SIPs early

✔ Increase SIPs according to salary increase

✔ Consider Corporate NPS (80CCD (2)) for tax savings Discipline = Builds wealth beyond returns.

Conclusion: Beyond earnings… Planning is wealth

Even a couple with an income of ₹1–₹2 lakh per month

With smart planning + discipline + security- wealth in crores can be accumulated.

✔ Health & term insurance.

✔ Strong emergency fund.

✔ Control expenses.

✔ Continuous SIP investments.

✔ Investing consistently for a long time.

This is the principle that turns even an ordinary couple into a wealthy couple!

Your journey to ₹11 crore

starts with just one SIP.

If you don’t start today…

When?

Reviewed for accuracy and last updated on December 2, 2025.